Leasebacks & Aircraft Leasing

Everything you need to know in order to prosper

Low Money Down & No-Doc loans now available on low rate financing!

Contact Us

Thank You. Your report will be prepared and reviewed, then eMailed to you at the address provided. If you need immediate assistance, here is our contact page: contact us

Please try again later.

Slide title

The plane of your choice while someone else helps pay for it.

Button

Slide title

Late model Cessna 172 Skyhawks are in huge demand. We have inventory now.

Button

Slide title

Piston Twins for training and charter, in good demand now

Button

Slide title

Immediate need for turbo-props to qualified FAA Part 135 Charter Groups.

Button

Slide title

Great Value now on Pure Jets. Need Lears and Citations to lease.

Button

Slide title

Lease to Leading Local Flight Operators

Button

Slide title

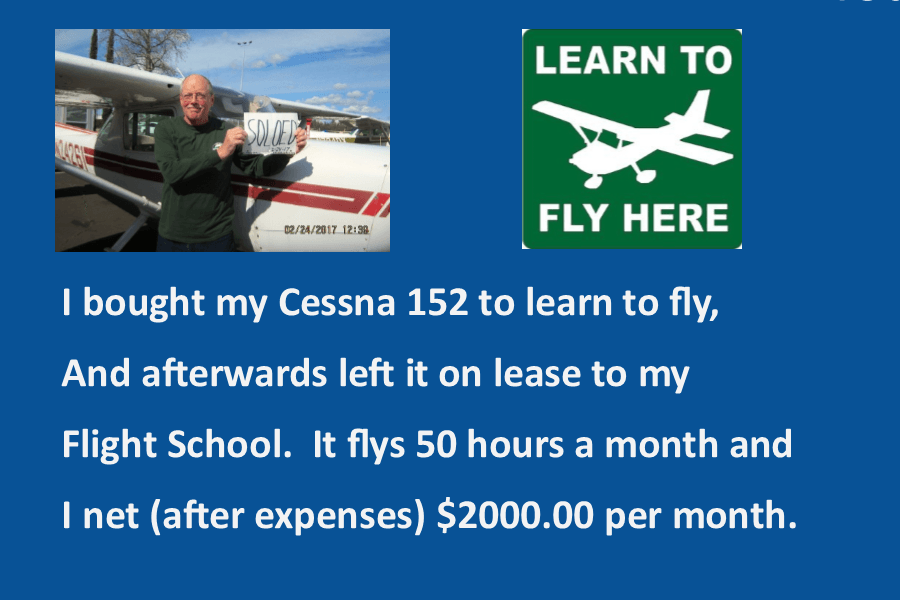

Successful Leasebacks can provide a sizable Cash Income for owners

Button

Slide title

Own a high performance complex single and lease it out for income.

Button

Slide title

Discover all the tax benefits of owning an airplane on leaseback.

Button

Contact Us

We will get back to you as soon as possible.

Please try again later.

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton